- Home

- 13% of colleges fear their solvency is at risk

13% of colleges fear their solvency is at risk

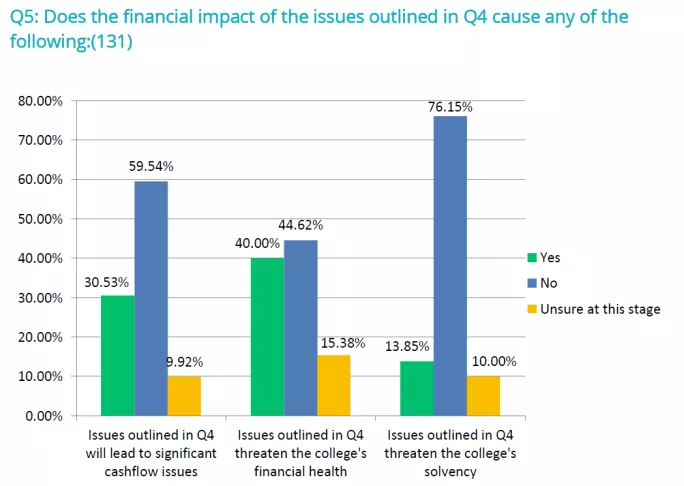

Four in 10 college leaders predict a deterioration in their college’s financial health as a result of coronavirus while a third predict cashflow issues and 13 per cent believe there could be “a significant threat to solvency”, according to a new survey.

A survey by the Association of Colleges on Covid-19 and colleges, shared exclusively with Tes, reveals that 40 per cent predict their college’s financial health will get worse due to a drop in income, while 15 per cent say they do not know if this will be the case.

Colleges had to close their doors for face-to-face teaching in March, following the outbreak of the coronavirus in the UK.

Apprenticeships: More than half of employers stop recruiting apprentices

Background: Why colleges need more support to cope with coronavirus

Coronavirus: FE commissioner pauses college work

“The financial impact of the shutdown on colleges has been severe,” the AoC’s survey report says, explaining that, on average, approximately 65 per cent of college income was guaranteed in both 2019-20 and 2020-21 regardless of actual activity, and around another 20 per cent in public funding would continue to flow until 31 July 2020 as a result of the actions taken by government in response to the pandemic.

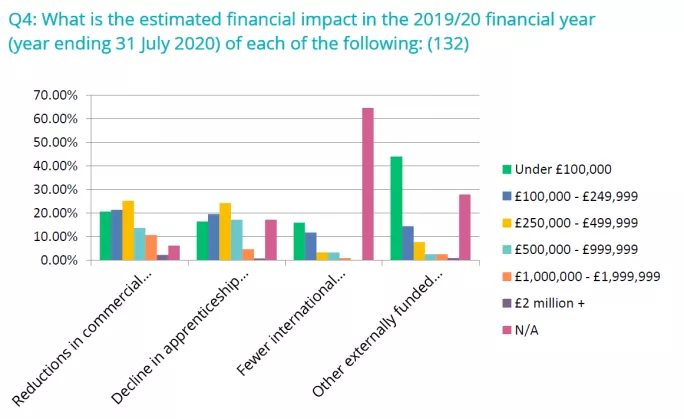

Coronavirus: The financial impact on colleges

However, colleges were seeing a substantial loss of income in 2019-20 from apprenticeships, summer term enrolments, international students, catering and a range of other commercial activities, adding up to about £150 million - or 2 per cent of total income, according to the AoC.

There had been some short-term savings for colleges from furloughing staff, travel and agreeing cost reductions on contracted-out services, but colleges had also incurred costs, for example in purchases of IT equipment and software.

There also continued to be major uncertainty and risks on all non-grant income lines in 2020-21 outside the 16-18 funding or adult education budget, says the report.

The survey, to which around half of England’s colleges responded, reveals that the most common areas of concern for college leaders were apprenticeship and commercial activity, while a small number of colleges have had a significant hit from the loss of international income, adult education fees or major contracts.

According to the survey, 30 per cent of college leaders believe the 2019-20 financial impact “will create significant cash-flow issues” and 13 per cent report “a significant threat to solvency”.

“Colleges provided this information in confidence but our review of the detailed data showed that only five respondents (4 per cent) reported a significant solvency risk before 31 July 2020, of whom one is already in full intervention, two were in early intervention and the other two are already taking robust action to stay out of trouble,” says the survey report.

“Of bigger concern are the six more who anticipate problems in autumn 2020, the further four who predict issues in spring 2021 and the possibility that there are others who may not think they have problems now but will fall into difficulty.”

The AoC says colleges “operate on very thin margins and incur fixed costs in advance to ensure quality, with risks that income will not be forthcoming, and have few places to turn for cashflow support”.

AoC chief executive David Hughes said: “Colleges have suffered a decade of neglect before this crisis, resulting in many colleges financially weaker than they would like. The crisis will make that worse, and our survey confirms that college leaders are deeply worried about their finances over the next 12 months and beyond.

“The government has given some certainty on about 60 per cent of college funding for next year, but there is enormous uncertainty about the remainder. Thriving colleges in every community will be needed to help people, communities and businesses emerge from this crisis, so we are proposing new investment as well as flexibilities in how existing funding can be used by colleges to meet demand and need. Much of that new investment has already been ear-marked for colleges, but we want to see it being allocated as soon as possible so that colleges can build the programmes and the capacity to help our country recover.”

A DfE spokesperson said: “We recognise the financial impact COVID-19 is having on colleges and we are providing unprecedented support to the FE sector. This includes setting up the Coronavirus Job Retention Scheme to fund 80 per cent of wages for furloughed staff, and deferring £30bn of taxes until the end of the financial year.

“We will continue to make monthly grant payments as scheduled for the remainder of the 19/20 funding year, and for 20/21 for which allocations have also now been confirmed. We are also protecting the grant funding to the FE sector which is worth over £3 billion over a full year. We will continue to monitor the situation closely and considering any further action which may be required.”

Keep reading for just £1 per month

You've reached your limit of free articles this month. Subscribe for £1 per month for three months and get:

- Unlimited access to all Tes magazine content

- Exclusive subscriber-only stories

- Award-winning email newsletters