Take control of your financial wellbeing with the Teacher Budget Planner 2025/2026.

Managing a teacher’s salary involves more than just checking your payslip. With pension contributions, union fees, student loans, and the rising cost of living, it can be difficult to see exactly where your money is going.

This interactive Excel resource has been designed specifically for UK educators to provide a crystal-clear picture of your household finances. It is fully automated, visually engaging, and tailored to the unique expenses teachers face.

Key Features & Benefits

-

Interactive Dashboard

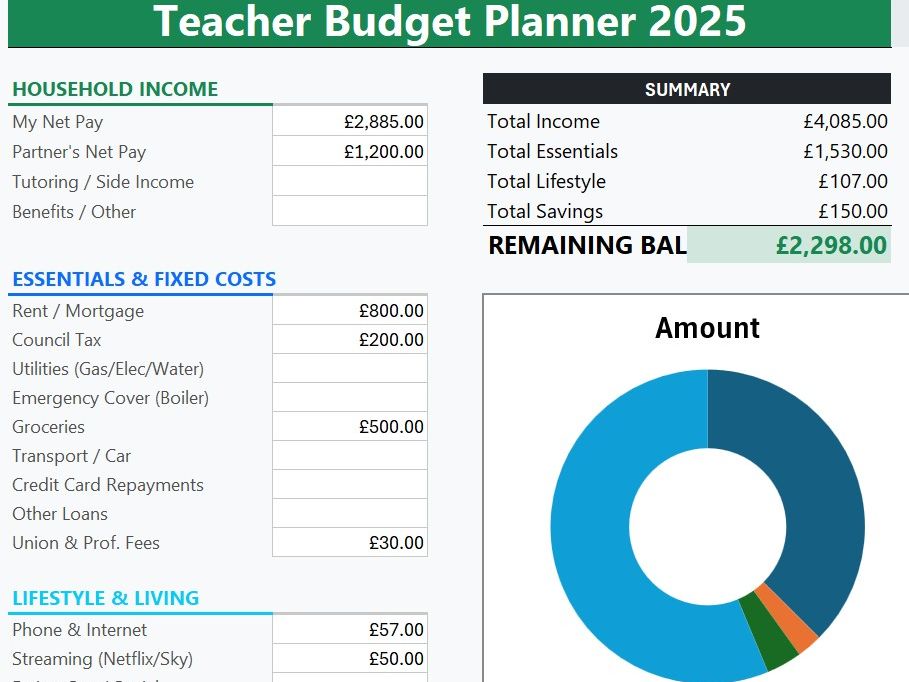

Forget boring lists of numbers. As you type your expenses into the simple white boxes, the spreadsheet automatically updates a beautiful Doughnut Chart. This gives you an instant visual breakdown of your spending:

Essentials: (Mortgage, Utilities, Transport)

Lifestyle: (Social, Streaming, Kids Clubs)

Savings: (Investments, Holiday Funds) -

“Traffic Light” Balance System

No need for a calculator. The “Remaining Balance” box updates in real-time.

Green: You are in a surplus (saving money).

Red: You are in a deficit (spending more than you earn).

Grey: You are breaking even.

This immediate visual feedback helps you adjust your spending habits instantly. -

Total Household Management

We know finances are often shared. Unlike single-person calculators, this planner allows you to input:

My Net Pay: Your take-home teacher salary.

Partner’s Net Pay: To budget as a team.

Side Income: Perfect for tracking tutoring money or exam marking payments.

Benefits: Child benefit or other allowances. -

Built-in Teacher Money Tips

The spreadsheet features a dedicated “Teacher Money Tips” section, offering reminders on:

Tax Relief: How to claim back tax on your union fees and socks/tights/PE kit laundering.

Discounts: Reminders to check Blue Light Card eligibility.

Pay Progression: A quick link to check your current pay scale position. -

Comprehensive Lifestyle Tracking

Modern life is complex. We have included specific categories for:

Kids Clubs & Activities: Essential for parent-teachers.

Streaming Services: Netflix, Spotify, Sky, etc.

Emergency Cover: Boiler and home cover.

Credit Card Repayments: Keep track of debt reduction.

Technical Details

Format: Standard Excel Workbook (.xlsx).

Compatibility: Works perfectly on PC, Mac, iPad, and Google Sheets.

Safety: This file contains NO MACROS. It is 100% safe, secure, and will not trigger school antivirus warnings.

Privacy: This is an offline tool. Your financial data stays on your device and is never uploaded to the internet.

How to Use:

Download the file.

Open it in Excel (or upload to Google Sheets).

Enter your figures in the white boxes (the rest of the sheet is protected to prevent you from accidentally breaking the formulas).

Watch the graphs and totals update automatically!

Download this resource today to reduce financial anxiety and plan for a secure 2025/2026.

Something went wrong, please try again later.

This resource hasn't been reviewed yet

To ensure quality for our reviews, only customers who have downloaded this resource can review it

Report this resourceto let us know if it violates our terms and conditions.

Our customer service team will review your report and will be in touch.