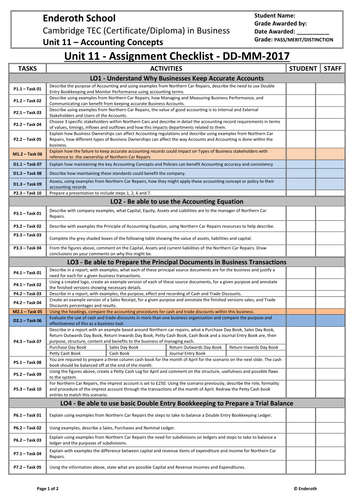

Cambridge Technicals - Business Studies Level 3 - 2016 Spec -Unit 11 - Accounting Concepts H/507/8158 delivery materials and marking assessment grid. Relatively easy unit. Any further details email me at enderoth@hotmail.com

Something went wrong, please try again later.

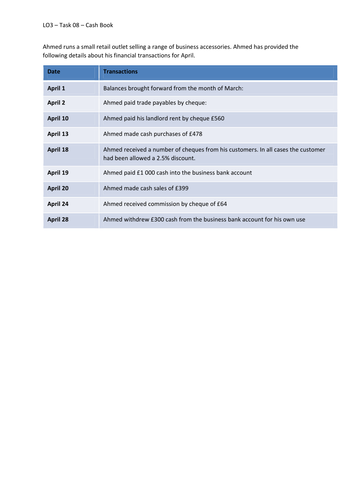

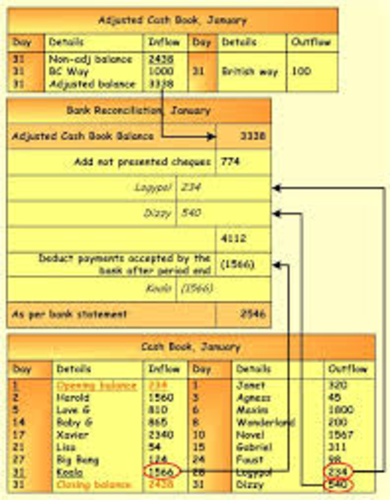

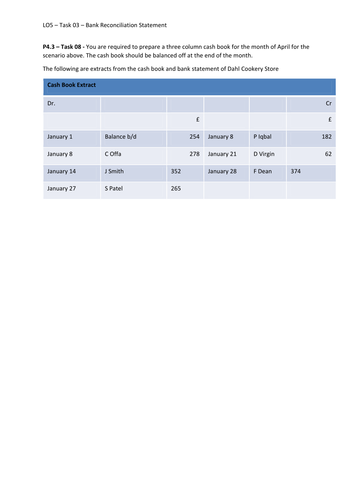

For the section in Task 2 where is says to update the cash book, this is the advice given. <br /> <br /> When businesses receive their bank statements they typically need to go through the following steps: <br /> · Check the opening balances are identical <br /> · Check (perhaps tick off) identical entries on both the cash book and bank statement <br /> · Look at the entries on the bank statement that have not been ticked off – assuming these are legitimate entries (not fraud/errors) then the cash book must be updated and a new closing balance can be calculated for the cash book<br /> · A bank reconciliation statement can then be drawn up to show remaining differences – these differences should be entries on the cash book that have not yet been ticked off<br /> <br /> Hope that helps

Thank You So much a comprehensive set of notes, this has saved me a lot of time

Report this resourceto let us know if it violates our terms and conditions.

Our customer service team will review your report and will be in touch.