This lesson is ideal for doing with Y11 students once they have done their GCSE exam. Or it can be used in a maths lesson when you have access to computers, or as an end of term lesson.

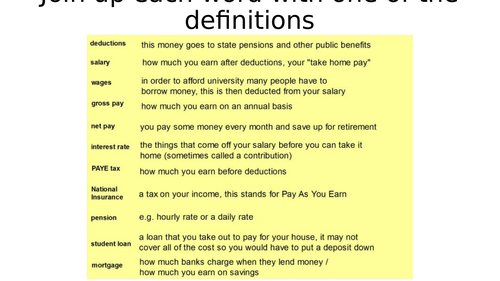

It begins by projecting up various finance words (01) and asking students to match these to definitions.

There are then some basic mortgage questions (02), for example what would a 15% deposit be on a house of this value.

The main part of the lesson is on take home pay (03). Students will be given a few minutes to think about their dream job. If they have their own computers they can do this, or I have included a list of average salaries from a few years ago as a back up (04).

I have created a template for students to use in order to show their calculations for each deduction. 1 tick means easier; 2 ticks mean harder.

There is no set answer to this as each student will be calculating different things. The purpose of this lesson is to really understand the basic finance terminology we use in day to day life and to be able to glance through a pay slip and do some basic checks to see if it looks correct.

(Computers are not essential for this lesson - they can be used for students to research average salaries for their chosen career and to read the information on NI and tax on their own. The teacher can project this up otherwise, which is what I did.)

Something went wrong, please try again later.

This resource hasn't been reviewed yet

To ensure quality for our reviews, only customers who have purchased this resource can review it

Report this resourceto let us know if it violates our terms and conditions.

Our customer service team will review your report and will be in touch.