Saving and Managing Money - Careers

Financial Education - Saving and managing money - Careers Lesson. Editable 22 slide PowerPoint Lesson, Lesson Assessment, Student Resources, Signposting to extra support services. Bonus Mindfulness Activity and much more.

✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰✰

Learning Objectives

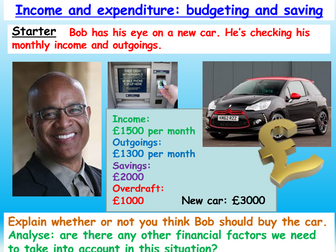

To define a variety of banking and financial key terms

To understand the importance of saving money and the different methods of storing it

To be able to identify the difference between essential and non- essential expenditure

Some Key Terms Covered

DEPOSIT BOX, BRANCH, DEBIT CARD, BANK ACCOUNT, NEEDS, WANTS, BUDGET, DEBT

** (Assessment) Objectives**

I understand the meanings of a wide range of financial key terms

I can evaluate different ways of storing money

I can explain the many advantages to having a bank account

Each Lesson Pack Contains:

☞ 1 Fully Editable PowerPoint (Learning Outcomes, Confidence Checkers, Assessment of Learning, Variety of Tasks, Video Embedded URL Clips, Engaging Premium Quality Slides, Extra Support Websites, Challenging & Thoughtful Questioning)

☞ Most lessons include a Worksheet

☞ Assessment Opportunity (Confidence Checker)

☞ Teacher Notes (On some slides)

⟴ Be Ofsted and DfE PSHE ready with our resources! Product Code: RSE/C8/LS/180

Why not check out some of our latest PSHE super bundles below:

Personal Finance as a young adult

Online Safety + Staying Safe

Y12 Survival Kit - Personal Safety

Y11 Survival Kit - Revision + Exam Stress

British Values Explored Bundle

PSHE - Debating Topical Issues

Society, Body Image + Peer Pressure

Finance Risk + Online Safety