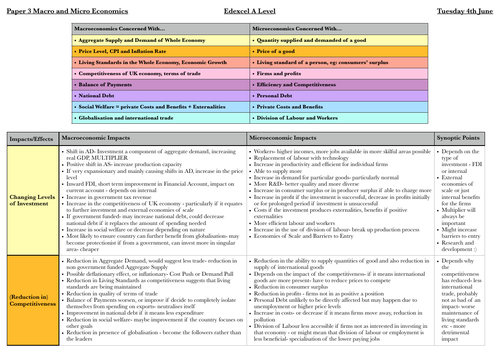

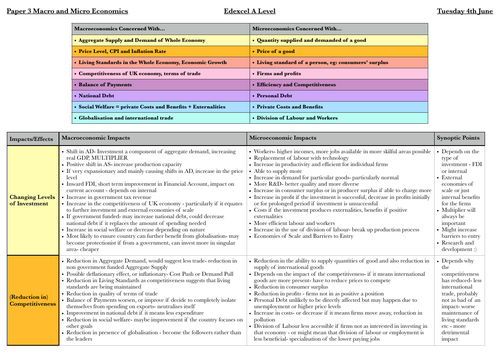

Paper 3 of the Edexcel economics A-Level course requires you to carefully consider both the micro and macro economic implications of economic events, policies, strategies and crises. These colourful, easy to use and detailed tables provide a scenario, listed with its micro and macro implications, and synoptic points in order to send your answers to A* quality. A unique resource that will extend your knowledge beyond the classroom. These notes will be particularly useful for students impacted by the COVID-19 crisis, as these topics are typically taught in the final term before the A-Level examinations.

Example:

Cutting Public Expenditure :

Macroeconomic Impacts

• Reduction in AD and AS- government spending a component and AS expansions normally funded by government

• Disinflationary impact - reduction in the amount of consumption in an economy, could be inflationary if the cut means a reduction in subsidies

• Reduction in living standards- less provision of the goods and services that public expenditure bring

• Reduction in competitiveness- or increase if it allows the market system to work more officially

• Worsen balance of payments if it means that British firms are less efficient and competitive

• Improvement in national debt in long run if it means no longer running budget deficits

• Decrease in social welfare if it means that government expenditure reduction removes provision of merit and public goods

• Could increase globalisation if it means less protectionism - decrease globalisation if it reduces the amount of national income- Marginal Propensity to Import

Microeconomic Impacts

•Reduction in the quantity supplied of public or merit goods or goods which depend on government expenditure

• If public spending has crowded out private spending then individual economies might witness more investment and the ability to be more efficient and competitiveness

• Price of goods likely to increase

• Living standards likely to significantly decrease- not the case if reduced

spending is a result of reduced taxes

• Profits likely to decrease if less consumption- might increase for firms

replacing government institutions

• Personal debt likely to increase as government spending covers spending

that would have to be taken on by the individual

• Increase in private costs, reduction in private and social benefits

• Workers might become unemployed

• Public Sector workers have reduced income if the cut in spending is a cut in wages

Synoptic Points

- Depends how the government expenditure was funded

- What services are removed as a result of the cut

- If it means the removal of inefficient subsidies possibly a good thing?

- Reducing arms spending - might mean more meaningful exp.

Something went wrong, please try again later.

This resource hasn't been reviewed yet

To ensure quality for our reviews, only customers who have purchased this resource can review it

Report this resourceto let us know if it violates our terms and conditions.

Our customer service team will review your report and will be in touch.