These 24 presentations have been designed to provide teachers of IGCSE Accounting with a complete set of presentations allowing a clear structure for delivering the full course.

The presentations match the following syllabus requirements

- Cambridge IGCSE Accounting (0452)

- Cambridge IGCSE (9-1) Accounting 0985

- Cambridge O Level Accounting (7707)

Click below for a free sample:

https://1drv.ms/p/s!Ana1JGS9UmnBmDLM8ubDZsfRjXPu?e=ySGMoY

There is, of course, a huge range of quality websites and textbooks that support student learning. With the aide of past paper questions, text book exercises, detailed texts and many quality videos available online, students should feel well resourced.

These presentations will save hard-pressed teachers hours of their valuable time.

Contents

Section 1 - The fundamentals of Accounting

1.1 - Purpose of Accounting

1.2 - The Accounting Equation

Section 2 - Sources of Recording Data

2.1a Double Entry (Assets and Liabilities)

2.1b Double Entry (Expenses and Incomes)

2.1c Balancing off accounts

2.1d The three Ledgers

2.2 Business Documents

2.3 Books of Prime Entry

Section 3 - Verification of Accounting Records

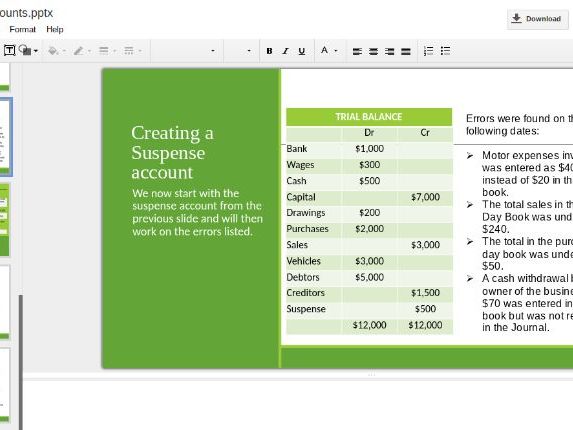

3.1 The Trial Balance

3.2a Correction of errors

3.2a Suspense Accounts

3.3 Bank Reconciliation

3.4 Control Accounts

Section 4 - Accounting procedures

4.1 Capital and revenue expenditure and receipts

4.2 Accounting for depreciation and disposal of non-current assets

4.3 Other payables and other receivables

4.4 bad and doubtful debts

4.5 Valuation of inventory

Section 5 - Preparation of financial statements

5.1 Sole Traders

5.2 Partnerships

5.3 Limited Companies

5.4 Clubs

5.5 Manufacturers

5.6 Incomplete Records

Section 6 - Analysis and Interpretation

6.1 Ration Analysis

6.2 Interpretation of Accounting Ratios

6.3 Inter-firm comparisons

6.4 Interested parties

6.5 Limitations of Accounting Statements

Section 7 - Accounting Principles and Policies

7.1 Accounting Principles

7.2 Accounting Policies

Something went wrong, please try again later.

This resource hasn't been reviewed yet

To ensure quality for our reviews, only customers who have purchased this resource can review it

Report this resourceto let us know if it violates our terms and conditions.

Our customer service team will review your report and will be in touch.