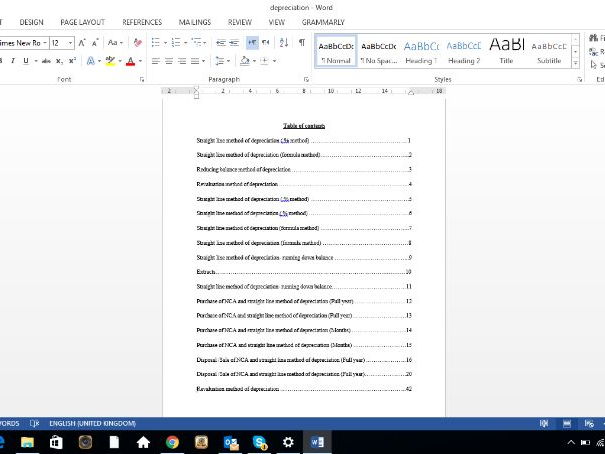

This is a worksheet which consists of;

1. Straight line method depreciation ( formula method/ % method, depreciation for full year, depreciation for months, purchase and disposal of non-current assets )

2 Reducing balance method of depreciation ( formula method/ % method, depreciation for full year, depreciation for months, purchase and disposal of non-current assets )

3. Revaluation method of depreciation

Note: all the questions are with complete format and steps to follow including blank income statement and statement of financial position extracts.

1. Straight line method depreciation ( formula method/ % method, depreciation for full year, depreciation for months, purchase and disposal of non-current assets )

2 Reducing balance method of depreciation ( formula method/ % method, depreciation for full year, depreciation for months, purchase and disposal of non-current assets )

3. Revaluation method of depreciation

Note: all the questions are with complete format and steps to follow including blank income statement and statement of financial position extracts.

Something went wrong, please try again later.

This resource hasn't been reviewed yet

To ensure quality for our reviews, only customers who have purchased this resource can review it

Report this resourceto let us know if it violates our terms and conditions.

Our customer service team will review your report and will be in touch.

£10.00