Resource Doctor

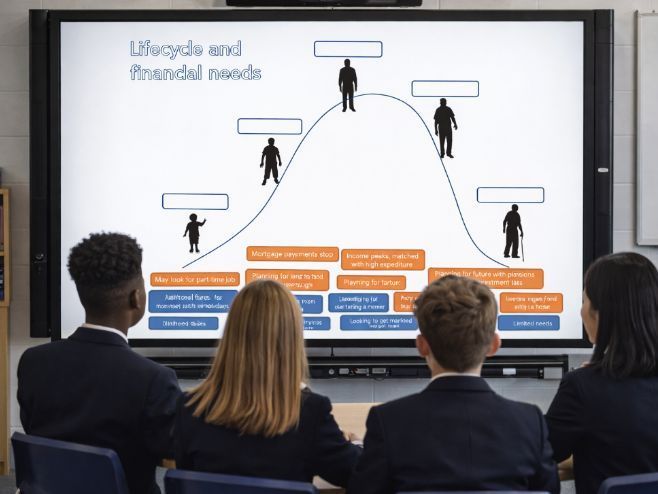

High-quality, classroom-tested resources for GCSE, BTEC and A Level Business, Finance and Citizenship. Every resource is fully ready-to-teach, saving planning time while delivering engaging, structured and impactful lessons. Designed and refined in real classrooms, our materials help students build confidence, independence and exam-ready knowledge. Trusted by teachers for professional, reliable and engaging learning resources