Grades: 10th to 12th

Financial Mathematics Problem Solving can be used for:

- Assessment: As a formal task to evaluate student understanding.

- Revision: For targeted practice and review.

- As Exam Question

The marking scheme is editable. Feel free to adjust it to your preferred criteria or school requirements.

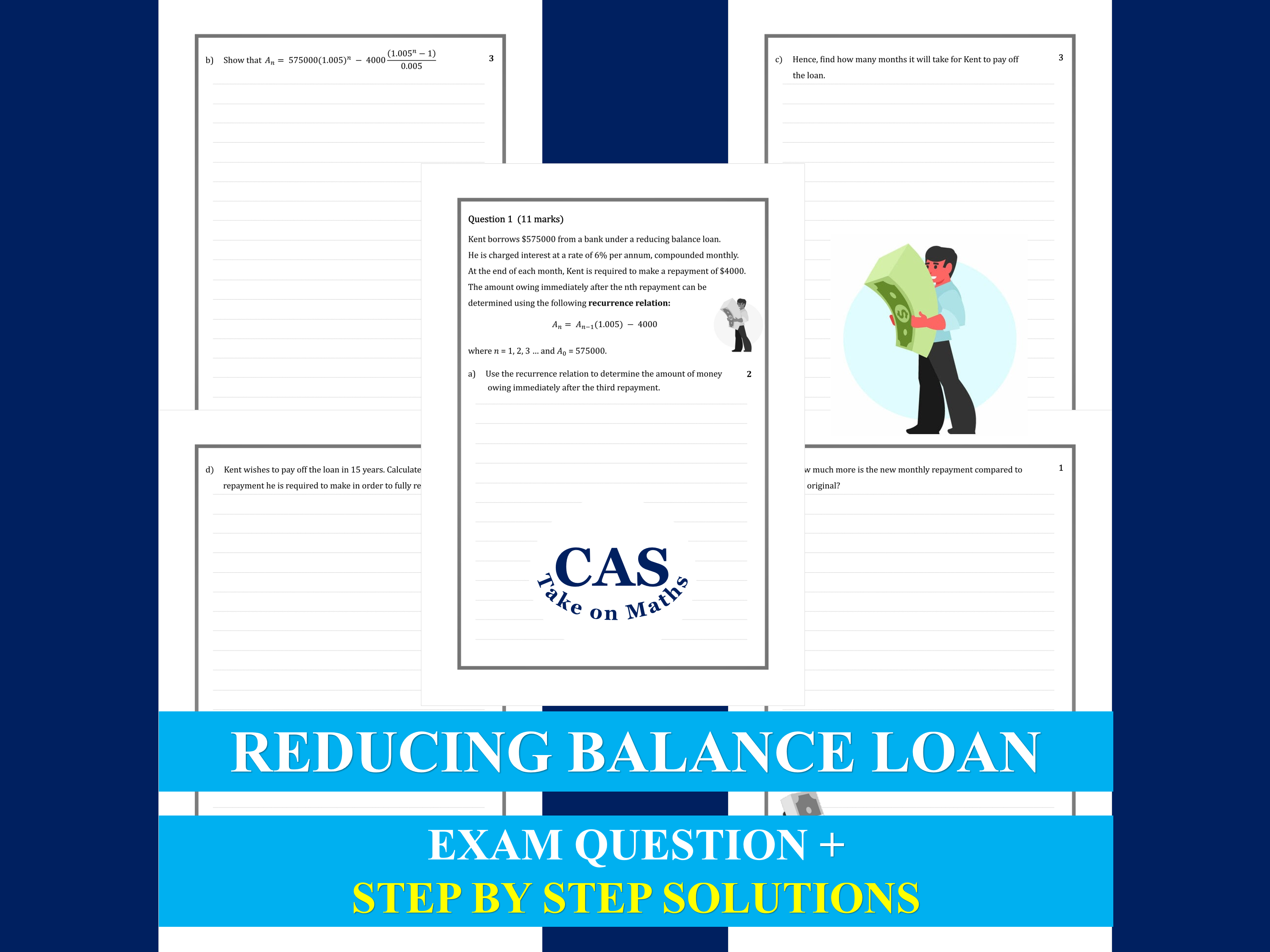

Focus Area: Reducing Balance Loans (Loan Repayments)

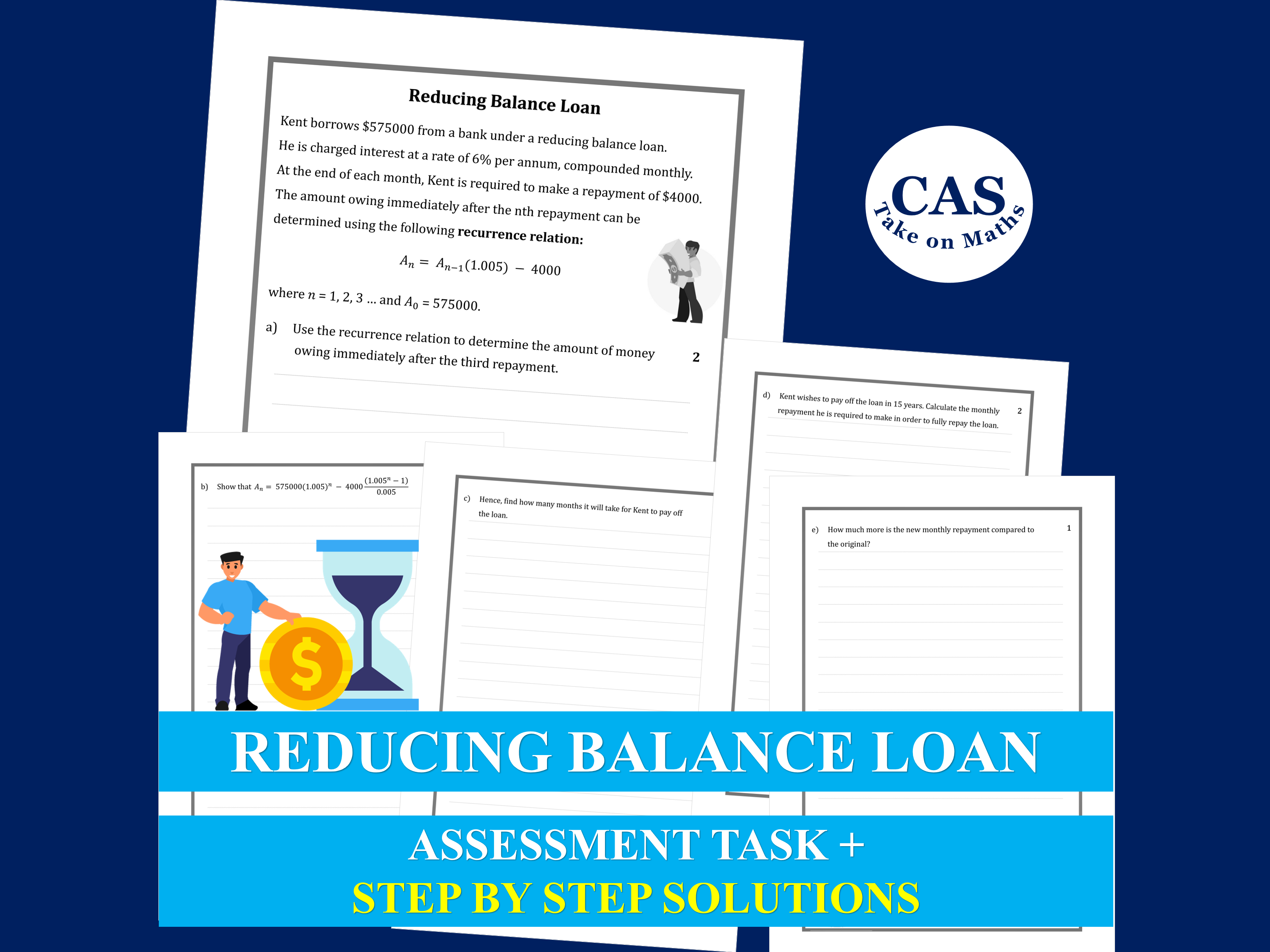

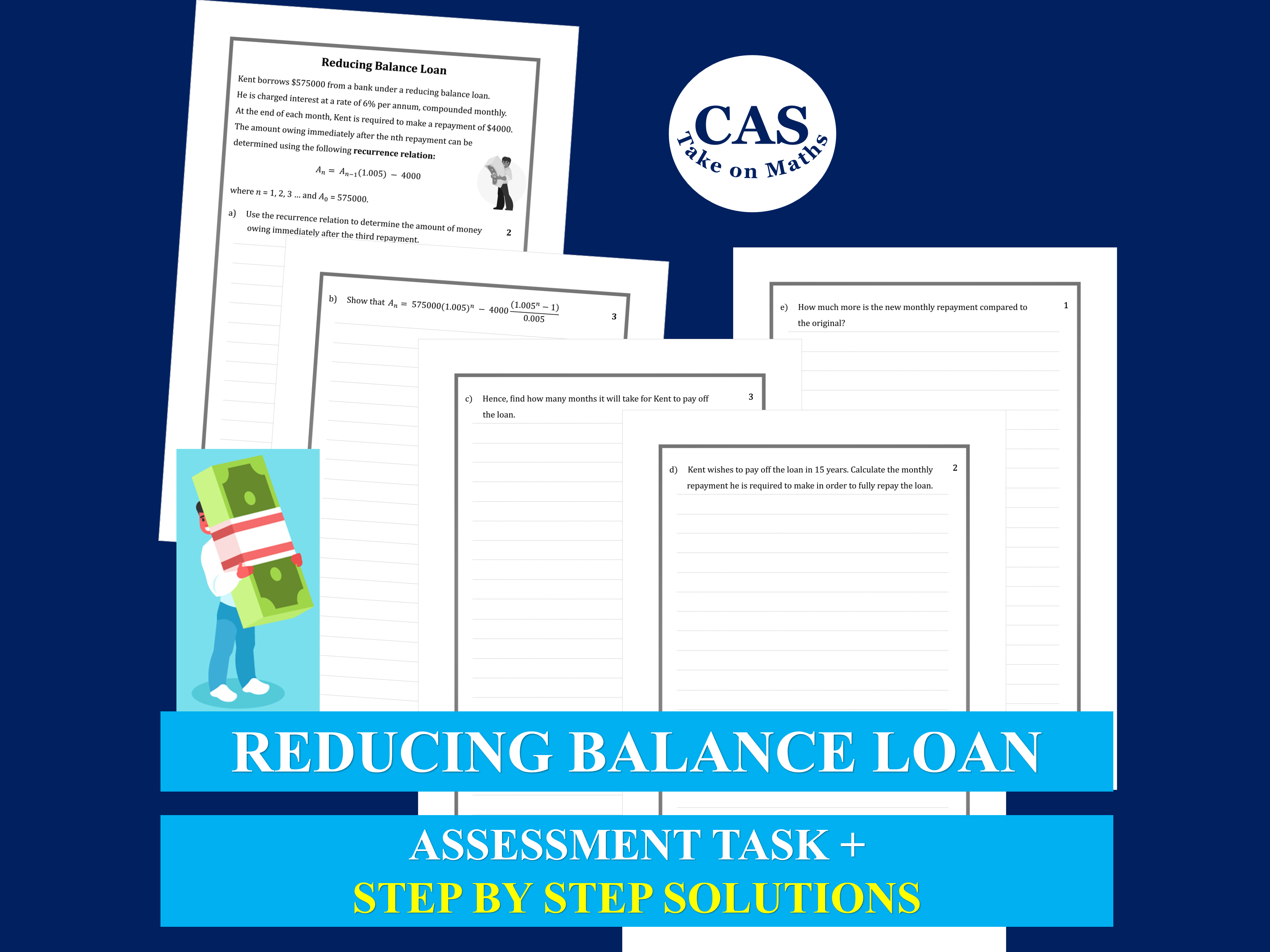

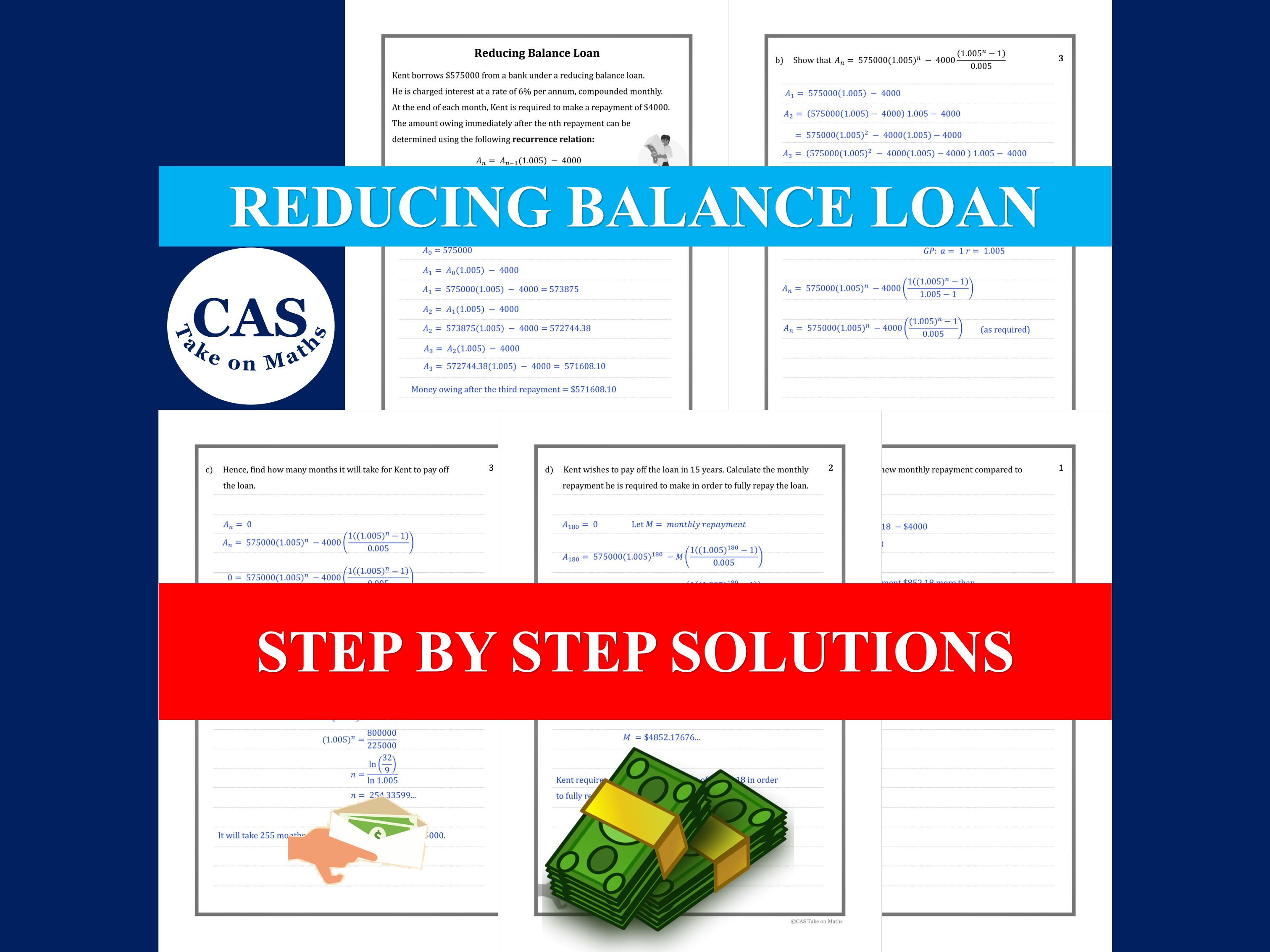

To assess students’ understanding of reducing balance loan calculations, include:

- Determining the time required to repay a loan based on the interest rate and fixed repayment amount.

- Calculating the monthly repayment needed to pay off a loan within a specified time frame.

Skill Development:

- Applying algebraic techniques to solve financial problems.

- Using geometric progressions to model loan repayments.

- Rounding money to the nearest cent.

- Converting interest rates and time periods between different formats.

Learning Outcomes:

-

Use a recurrence relation to model a reducing balance loan and investigate the effect of the interest rate and repayment amount on the time taken to repay the loan.

-

Solve problems involving reducing balance loans; for example, determining the monthly repayments required to pay off a loan.

Also comply with Australian Curriculum:

Use a recurrence relation to model a reducing balance loan and investigate (numerically or graphically) the effect of the interest rate and repayment amount on the time taken to repay the loan (ACMGM097)

With the aid of a financial calculator or computer-based financial software, solve problems involving reducing balance loans; for example, determining the monthly repayments required to pay off a housing loan. (ACMGM098)

Something went wrong, please try again later.

This resource hasn't been reviewed yet

To ensure quality for our reviews, only customers who have purchased this resource can review it

Report this resourceto let us know if it violates our terms and conditions.

Our customer service team will review your report and will be in touch.